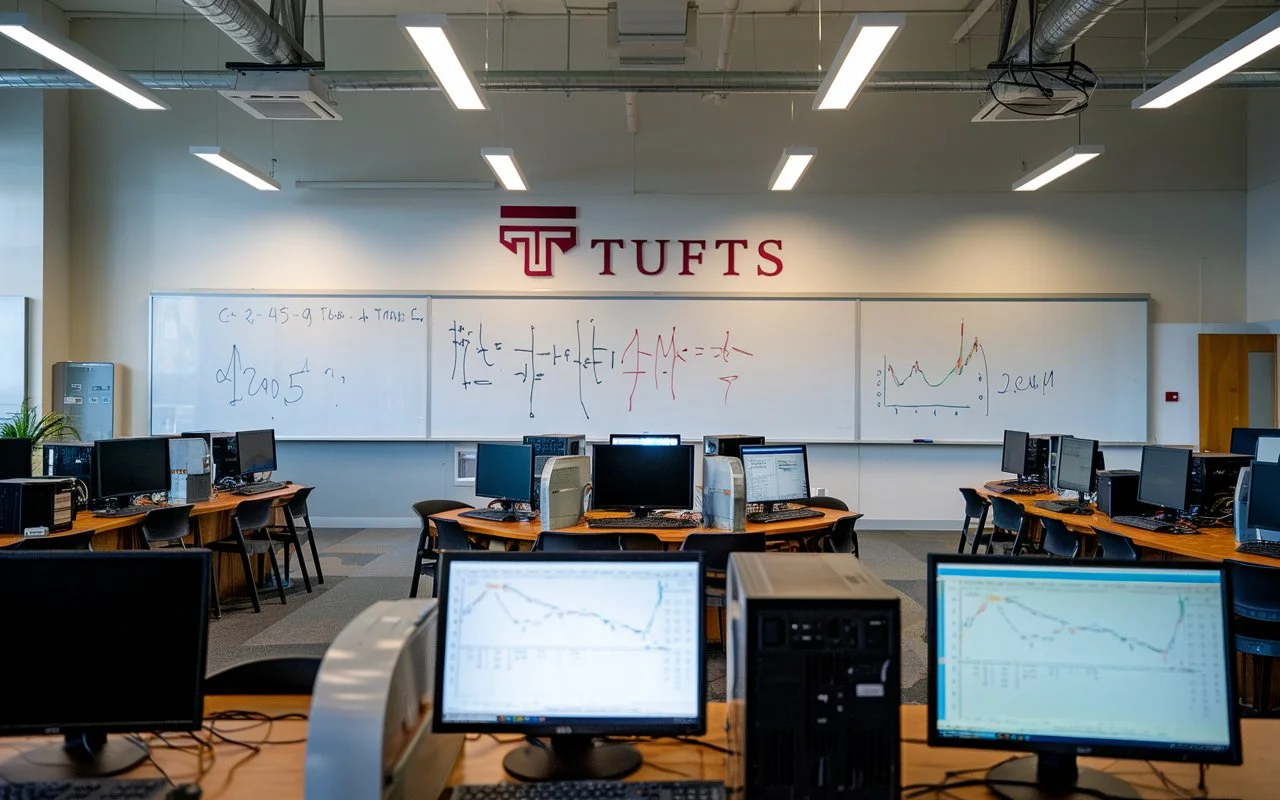

Combining computational methods with finance, the Tufts CS116 Technical Analysis Lab is intended to give students practical experience in financial data analysis, algorithmic trading, and market forecasting, so developing fundamental technical analysis skills for making data-driven financial decisions. While giving students the chance to work on practical projects using the course’s core themes—time-series analysis, technical indicators, machine learning for market forecasts, and portfolio optimization—it also covers those ideas. It also fits similar classes like Tufts’ CS170 and CS115, therefore improving students’ grasp of computational theory and algorithms. Prepared for professions in fintech, hedge funds, and investment research, students acquire the knowledge and skills required to evaluate financial data, create trading algorithms, and make wise judgments in the financial markets by the conclusion of the course.

What Is Tufts CS116 Technical Analysis Lab?

Tufts CS116 is a computer science course with a finance focus combining programming, quantitative analysis, and financial modeling. The lab also teaches students technical analysis, a method traders and analysts apply to evaluate equities using previous price data and volume. Moreover, this strategy gives pupils the means required to make wise selections in financial markets. They so acquire useful abilities directly applicable to actual trading and investment situations. CS116 ultimately enables students to close the distance between computer science and finance.

Key Features of CS116:

✔ Hands-on coding experience with financial datasets.

✔ Algorithmic trading models using Python and R.

✔ Market trend analysis through statistical and machine learning techniques.

✔ Risk assessment and portfolio management strategies.

Students interested in quantitative finance, machine learning in trading, and financial engineering should find the course appealing.

Course Topics and Learning Outcomes

Students in Tufts CS116 Technical Analysis Lab gain expertise in analyzing stock market trends, developing predictive models, and applying financial indicators.

Core Topics Covered in CS116:

📌 Introduction to Technical Analysis – Grateful for price charts, candlestick patterns, and market psychology.

📌 Time Series Data Analysis – Forecasting using statistical techniques and Python.

📌 Algorithmic Trading Strategies – Building automated trading systems.

📌 Machine Learning in Finance – Using stock prediction AI models.

📌 Risk and Portfolio Management – Managing financial risk using technical indicators.

By the end of the course, students can apply data-driven strategies to evaluate financial markets and develop trading models.

How Tufts CS116 Compares to Related Courses

Many students also explore related courses like CS170 Tufts, CS115, and CS116 UCI, which focus on different aspects of computational finance and data science.

| Course | Focus Area |

| Tufts CS116 Technical Analysis Lab | Financial data analysis and trading models |

| CS170 Tufts | Machine learning and AI applications |

| CS115 | Data science fundamentals for various industries |

| CS116 UCI | Technical analysis with a focus on economics |

Students often use Tufts CS116 as a stepping stone to more advanced coursework in quantitative finance, AI in trading, and market simulation.

Tufts CS116 Technical Analysis Lab GitHub and Resources

For students looking for additional materials, GitHub repositories provide code examples, trading algorithms, and financial datasets.

Where to Find Resources:

🔹 Tufts CS116 Technical Analysis Lab GitHub – Contains assignments, sample projects, and research papers.

🔹 Mchow01 and Other Contributors – Users often share code implementations of trading strategies.

🔹 Open-Source Finance Libraries – Utilize Python packages like TA-Lib, pandas, and NumPy for analysis.

These resources help students deepen their understanding and build real-world technical analysis models.

FAQs

What programming languages are used in Tufts CS116?

Development of trading strategies and financial data analysis mostly depends on Python and R.

How does CS116 differ from CS170 Tufts?

CS116 focuses on technical analysis and market data, while CS170 is more about machine learning applications.

Where can I find Tufts CS116 Technical Analysis Lab GitHub projects?

Many students upload their coursework to GitHub. Searching “Tufts CS116 GitHub” will lead to repositories with sample code.

Is Tufts CS116 suitable for beginners?

A background in basic programming and finance is recommended, but students with strong analytical skills can succeed.

What career paths does CS116 prepare students for?

Roles in quantitative finance, data science, financial engineering, and algorithmic trading fit this course.

Conclusion

Under the Tufts CS116 Technical Analysis Lab, students develop practical abilities in quantitative modeling, algorithmic trading, and financial data analysis. Additionally, this course offers hands-on experience with real-world financial datasets. By doing so, students gain valuable insight into how financial markets operate and how data can be leveraged for decision-making. Furthermore, they learn to apply advanced analytical tools and techniques, which are crucial for creating and testing trading strategies. As a result, students not only enhance their theoretical knowledge but also acquire practical skills that are essential for success in the finance industry.

Moreover, by merging computer science with finance, the course equips students with the necessary tools to maximize portfolios, evaluate markets, and create effective trading strategies. This integration helps students develop a deeper understanding of financial markets and enables them to make more informed decisions. Therefore, it arms them with the ability to tackle practical problems, preparing them to design sensible trading plans.

Furthermore, anyone interested in quantitative finance and data-driven decision-making should definitely consider studying CS116. Not only does it provide access to exciting opportunities in fintech, hedge funds, and investment research, but it also paves the way for future professional success.